World stock markets–Valuations vs. Corruption Index.

Interestingly: Valuation in the USA is extremely expensive. That is not a timing indicator but a long term indicator. The best market to invest in right now is Singapore. They have good valuations and low corruption. Australia, Spain, the UK and Belgium look good too.

I hope that global data gets implemented before the next crash!

2020 Global Valuations.xlsx (22.3 KB)

Where did you get this data?

And would international data cover Singapore?

- MktCap/GDP: Gurufocus .

- Yield: Portfolio123.

- Corruption Index: Transparancy Int’l. It’s from a few years ago because I found a table that was easier to import to Excel. The index has changed a bit over the past few years but not dramatically.

- Value rank: Derived from current and historical MktCap/GDP and from yield. See details in attached spreadsheet. I didn’t use the GuruFocus return estimates but the results are roughly similar in most cases.

Only if there is enough demand. They decided to start with the UK, presumably to appeal to the home country bias of UK investors, and because they hope to cover Europe next, which would appeal to the European investors who frequent this site.

Note that the UK is ranked near the top for value and quality.

The indicator set a new all time high on Friday.

The U.S. market is expensive; particularly when it comes to large caps; or more specifically, large growth. This has two implications; timing and risk.

Timing:

Valuation is not effective as a short term indicator. In fact, just the opposite. When valuations are high, it’s a sign that there are forces acting on the market to push it up. As long as those forces remain in effect, the market tends to continue to go up.

Risk:

However, long term those forces change and valuations eventually matter. Typically, this transformation happens during and after a crash.

The bottom line:

We shall see what the new president will do, but if stimulus round two passes, it should push the U.S market higher for at least a few months.

The shiller PE still has a little way before all time high so maybe we are good until it catches up.

Gurufocus says: Implied future annual return: 1.5%

This is a meaningless number - is this the expected return over the next 100 years or the next one year?

The market is in elevated territory - the expected 10-year real forward return is about 5% according to my forecast using the CAPE-MA35 Ratio method.

Are you taking into account a strong possibility the USA will default and the dollar will be massively devalued if we don’t stop printing $$ and get our collective !#&* together?

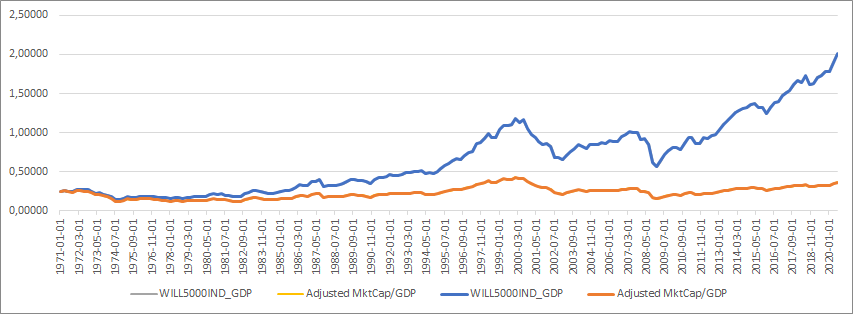

I think there is one evident flaw with the Wilshire 5000 Total Market Full Cap Index/Gross Domestic Product ratio ( https://fred.stlouisfed.org/graph/?g=qLC ): the index is total return. Dividends should not be included, because they are a compensation for holding stocks and do not impact valuations per se. In the same vein I would argue in favor of stripping out buybacks as well. This can in part explain the difference with other countries with little to no buybacks.

Assuming a not unreasonable 3.5% distribution yield between dividends and buybacks in the last 49 years, the current value of 2.01 would have to be divided by a factor of 5,5371 [ (1+0.035)^(2020-1971) ].

Under this light, the current 0.3633 is high, but not astronomical.

You can find my calcultations here:

https://docs.google.com/spreadsheets/d/1tRSSmulMUp390QMjC4nybmIG3NVcd442-DTK_dFsSZE/edit?usp=sharing

The higher valuation today is explained by the fact that in the last 50 years corporate profits doubled compared to the GDP, because of a higher share of GDP remunerating capital instead of labor and lower corporate tax rates. Not to mention interest rates. So, if you are saying the market is high, what you probably mean is that corporate profits after tax are high (namely the market ROE%). And I agree with you.

The US is not alone in printing its way out of the crisis. I see a significant devaluation of the dollar just in the case of a sudden (and suicidal) tightening by the ECB, BOJ and PboC.

As long as there is a strong, globally coordinated fiscal and monetary expansion, I don’t see significant downside for equity.

Thanks Riccardo. Very interesting analysis.

At which point would you consider the valuations to be astronomically high using your valuation method?

Are there any ratios or fundamentals that more accurately reflect where valuations stand today?

I assume none of these:

The world is collectively going through an aging of the population, with an entire generation of baby boomers moving into retirement with a smaller, younger demographic behind them creating an inverted demographic pyramid. An unprecedented global demographic event. The largest sovereign wealth funds are state sponsored pension systems who have to get to a certain percentage of returns to keep sending their checks in the mail. Many are bound by contract to hold a certain amount of “risk free” holdings – treasuries that are now paying near zero. If they aren’t making up the difference in equities, what asset class are they getting the returns from?

Good point. I guess that means its going to be that much more painful for boomers if/when the FED stops propping up the economy with free money and/or raises interest rates to fight off the inevitable hyperinflation.

This is exactly right.

You can’t just look at a P/E and say its high or low unless you also look at the components that make a P/E what it is and argue why they, on the whole, are high or low.

If you think the market is going to run into trouble, you should be discussing these components.

Interest rates are scraping along their mathematical lows so there is no more sustainable upside that can be attributed to this factor. So as far as stocks go, interest rates are neutral or bearish.

Profit growth is a much more challenging call. The market is expecting good things economically. We’ll have to see if covid or national politics makes that assumption turn out good or bad. Politically speaking, the trend of more GDP going to providers of capital versus labor is under pressure, and continuation of the Trump corporate tax cut is in jeopardy. The Dems did underperform in Congressional elections so reversal is not a sure thing. But the left is still here and covid is likely to tie Congress’ hand (no company can grow profits if customers don’t have money).

I think the market will stay good for a while, but the level of risk is much more elevated now than it’s been n a very long time because the easy P/E gains (declines in interest rates) are gone and the hard ones (growth in earnings) have much to prove over the 3-5year time frame.

For now, it’s about cyclicals and financials but for longer plays, the key is still with the secular growth companies, which were very strong in 2020 and may need a breather or correction as the market continues to re-assess profit prospects and how to value them. If you want to stick with quanting and testing on p123, I suggest devoting your energies to working with a small InList consisting of the SPDR sector specialty ETFs and looking for a technical model that can help you spot rotations. If you get something you like, then do a regular screen-ranking but with Sector filters at the top. (You might also do something similar with a tiny Inlist of size-based ETFs to point you to large, mid, small, or micro.)

And don’t underestimate the power of simple screening and manually choosing interesting stocks. If you never learned how to extract good information from the p123 Panels what you can find in company Investor Relations sites, this would be a really great time to develop that skill.

Using the adjusted MktCap/GDP model, the valuation peak in 2000 was 20% higher than now, so that would be a “very high” value (equivalent to a 4320 S&P in 2020).

You also have to consider that back in 2000 the GDP was at its cycle peak, while today it is lower than the precovid peak. Assuming potential GDP (without lockdowns and restrictions) is at precovid peak, you have some additional % points of safety margin.

In all honesty I am not sure how reliable the table you are pointing at is. For example, thier 48 EV/FCF (top 100% percentile) is way off from Factset data:

You can find my aggregate series here: https://www.portfolio123.com/app/series/summary/5500?st=0&mt=8

Ricardo,

The GDP data is not point in time, while MktCap data is point in time.

The GDP series values are the final revised values listed on the first day of the quarter to which they refer. Therefore the data is four months displaced from real-time, because the final values are only known four months after the the beginning of the quarter.

Good point Georg, the lag between the quarter and the final revised value is considerable and that is the main pain point in using the raw GDP data as the denominator. Revisions themselves and not being point in time less so in my opinion, because usually the market doesn’t react much to GDP unexpected revisions, unless they are massive.

In any case, an alternative denominator could be the Nominal Potential GDP:

It is an estimate from the Congressional Budget Office about the level of GDP assuming high capacity utilization in the economy, also available for the next 10 years.

Interestingly, your model upper limit for the S&P500 price is very close to the Adjusted MktCap/GDP limit, just below 4500.

Do any of these well thought out explanations really matter if the general public and institutional investors don’t understand it?

Is Perception reality?

Both Dalio and Marks have recently argued higher PE ratios may be justified by lower interest rates. Hedgeye is predicting a global Quad 2 for the first half of next year, which is generally very strong for equities; just about every country. And Edward Yardeni recently wrote in a morning briefing that we could be looking at the roaring 2020s. Yardeni also recently wrote about the possibility of increasing corporate profit margins because of lasting COVID productivity gains. So although valuations are high, there are also lots of positives.

From Ray Dalio Yesterday, "bonds are trading at roughly 75x earnings. With the amount of money out there, and cash being such a bad alternative, there’s no good reason that stocks couldn’t trade at 50x earnings. "

https://www.reddit.com/r/IAmA/comments/k9b4g8/im_ray_daliofounder_of_bridgewater_associates_we/

From Howards Marks (Undated but fairly recent)

"When Treasury notes yield a more normal 3%, investors might demand a return of, say, 6½% (incorporating an “equity premium” of 350 basis points) if they’re to invest in the S&P 500 instead of Treasurys. The S&P offers such an “earnings yield” when its earnings represent 6½% of its price, which written as a fraction is 6½/100. The ratio of earnings to price is obviously the inverse of the ratio of price to earnings, or the p/e ratio. An earnings yield of 6½/100 equates to a p/e ratio of 100/6½, or 15.4, which is a rough approximation of the S&P’s average p/e ratio since World War II.

Now let’s assume a Treasury yield like today’s 1%. To offer the same 350 basis point equity risk premium, the earnings yield only has to be 4½%. And an earnings yield of 4½/100 implies a p/e ratio of 22.2. So, in theory, assuming S&P earnings are unchanged, a reduction of the required earnings yield from to 6½% to 4½% calls for an increase in the p/e ratio, and thus in the price, of 44%. This is another way to describe the impact of lower interest rates on asset prices. Lower rates mean higher prices for stocks, just as they do for bonds. (Note: since companies’ earnings generally grow while bonds’ interest coupons don’t, it can be argued that required return on stocks should be even lower, meaning p/e ratios can be even higher.)"

https://www.oaktreecapital.com/docs/default-source/memos/coming-into-focus.pdf