After this huge rally from the bottom in late March, is it too late to chase?

Bear markets don’t go down in straight lines. The biggest rallies also occur in bear markets. Maybe I’m wrong but then this would be quickest Bear market in history. I think there is too much optimism in the markets in the face of the economic implications of the virus. Some would argue it’s already priced in. Maybe, maybe not. It’s possible a lot of sellers are waiting for technical thresholds before selling to break even or come out ahead. I wouldn’t be surprised if there is another wave of selling once cases and deaths peak in the US.

It’s not priced in at all. PEs are near historic highs. Unemployment is at historic highs. Historically, bear market recoveries have been relatively quick when there was no recession (such as the crash of 1987) and has taken a lot longer when there was a accompanying recession (such as during the GFC).

Just because something happened in the past is no reason that it has to happen in the future. This time is truly different. During a normal bear market whch accompanies a recession, there is a contraction of the money supply. People (and businesses) default on their loans, which makes lenders short on cash, which in turn causes lenders to sell assets, which in turn causes prices to fall, which in turn causes more people to sell. However, this time, the US Government is doing its best to pump money into the system. Notice how the recent bottom happened right around the time of the CARES act?

That’s one argument for a quick recovery. The second argument is that if we end the shutdown by the end of April (for example if a cure is found, or if many are found to already have antibodies, and that this testing can be rolled out very quickly), then it may save most from bankruptcies, and have a V shaped recovery.

On the other hand, there is quite a bit of downside. Normally, a bear market market is when PEs get incredibly cheap. PEs overall are not yet incredibly cheap.

If the U.S. market recovers quickly, I will be looking for cheaper markets elsewhere. The upside would be limited and the downside would be amplified. But if there will be a new low down the road, expect it to be the buying opportunity of a lifetime.

Good point Chaim.

Perhaps related and pertinent:

[i]"……Credit Suisse chief equity strategist Jonathan Golub - usually one of the most bullish Wall Streeters - posted a quick observation suggesting that any “temporary” cheapness in stocks hit in late March was long gone for the simple reason that forward earnings have plunged. As a result, as of noon when the S&P 500 had risen as much as 22% from March 23 lows, forward stock multiples had surged right back 19.0x.

Why is this notable? Because as Golub writes, “this is the same level the S&P500 held on Feb 19, the all-time high.”[/i]

Perhaps also of note (but not necessarily) is that GS thinks the “impact from Coronavirus on 2020 EPS” in Tech and Healthcare will be -10% (tech) and 0% (healthcare) respectively. Are these sectors back to their previous highs with regard to multiples?

Back of envelope: XLK (tech sector) down 19% from high and XLV (healthcare sector) down roughly 12%.

This is NOT, in anyway way, a prediction as whether there will be another leg down or not (because I obviously do not know and I should be your least trusted source were I to pretended to know).

Best,

Jim

Depends on your age, earnings, time horizon.

Attaching chart of typical US recovery path after >20% leg down… and note on how ‘recessions’ unfold. It ‘could be over’ as this is event driven ‘correction’, if it doesn’t end in recession (as Chipper has said – and I’ve written in other posts). It could get a lot worse still economically – but feels like at this point, the economic effects / unknowns ‘probably’ outweigh the disease related ones (although a rebound of Corona and/or mutation to worse variation is possible, I hope it doesn’t happen and have no reason to suspect it will – other than Spanish flu was worse the second rebound wave… so it could).

I never felt real emotional capitulation in the market this time around because of the speed – and fact there were constantly still people I knew asking if they would buy. So, emotionally it didn’t feel like a bottom to me. But, it feels like the market wants it to be – and wants a V snap back.

So hard to say. Best thing is to figure out where you want to be in 2 years and start dollar cost averaging into positions.

Time for ‘peak defensive’ mode is past – time for ‘if this is short, I’m gonna get really aggressive’ is also past. We’re somewhere in the middle. 20% cheaper (or more) than start of year – with lots of jet fuel from the government stimulus and lots of uncertainty from the economic ripples –

So, down 20% isn’t really ‘chasing stocks’? But, if you have long-term horizon and cash – and you are underweight where you want to be, it’s a decent time to deploy some (but not all) of that cash – say 1/4 to 1/3 to 1/2.

But, look for things you want to own at the current prices. Some people say UK stocks now attractive – I haven’t really looked – but they were beaten down by Brexit and now some currency issues and Corona. But, it can always get cheaper (or not)

Could also buy JETS ETF and bet that a bunch of airlines will avoid bankruptcy and really rebound – even though flying empty flights today.

If I had to assign my current probabilities – it’s something like this:

I think it’s 35% bet the market rallies quickly up (erasing losses YTD in 1-3 months) and never retests the march lows and is higher in 18 months… 50% chance the market bounces around a little for next 30-90 days trying to figure out direction, economic impacts etc (i.e. some big loan defaults or big financial sector hits due to credit card default rate spikes or some geopolitical uncertainty as countries act out or whatever – we don’t know what – but we know something will happen as uncertainty ripples…)… and a 15% chance we go way down big / fast soon (maybe from disease rebound / mutation / worsening – maybe something else economic or geopolitical).

There was some ‘capitulation’ in march – I know some people who ‘sold everything.’ And maybe that will be it. But, I knew a lot more people buying and rebalancing into it. So, those are my current ‘gut odds.’

No one knows for sure, but I’ve been buying aggressively this whole time, and will continue to do so, as I still maintain that the media-driven panic is overblown. Sure, something could happen and make the market spike down again, but that is true at any time in history, including robust bull markets. That’s how this panic started, during a robust bull market when nobody was thinking about risk. Now that we had a panic, everyone is hyper-focused on risk. The way I see it, investors hate uncertainty, and with each passing day, investors realize that the apocalypse didn’t actually happen, and uncertainty slowly fades away. Covid deaths will peak, and treatments and vaccines will be developed, and people will realize the shutdown is temporary.

But who knows, I’m probably totally wrong and we just started the second great depression.

Currently the S&P 500 Price/Book is at 3.00. At the end of the financial crisis recession it made a low of 1.78 before turning upward again.

Compare this to the DAX Price/Book which currently is at 1.16. Its 2009 low was about 1.0.

The S&P has still plenty of downside.

If you really have too much cash, it may not be a bad time to initiate prudent positions in defensive stocks (I prefer cons. staples now). If you are already more than 50% in US stocks, it might be a good time today to sell a bit of them. Just my 2 cents, you pay the rest.

I’m expecting high valuation multiples as long as interest rates ~0%, thought not everything is expensive.

Large Cap Growth vs. Small Cap Value returns now approaching dot com levels.

[quote]

I’m expecting high valuation multiples as long as interest rates ~0%, thought not everything is expensive.

[/quote] Why? Didn’t Europe have lower rates and lower PEs than the US?

Because US large cap companies, especially tech companies are global companies and sit on a lot of cash to avoid paying taxes on them. And Cash + Low interest rates =elevated PEs.

https://aswathdamodaran.blogspot.com/2015/05/valuing-pricing-cash.html?m=1

Market’s decided bottom’s in – for near-term.

But, we still have news like this happening (AirBNB predicting 54% revenue drop this year… not this quarter, this year).

And the reports on the medical side – show huge, global response – but likely there will be repeat impacts on productivity for a good chunk of time still.

See:

So… the market has decided it wants the bull run to continue – but countries around the globe have leveraged up and injected cash – and how this ‘debt’ all gets handled – and the strings of defaults will be interesting.

Well, how accurate were these “predictions” in the past?

Do they have more accuracy than chance?

Dang those polls are usually contrarian indicators. Maybe the market really has found a bottom? On the other hand perhaps not but this tells me to expect that the current move might have more legs to it than believed.

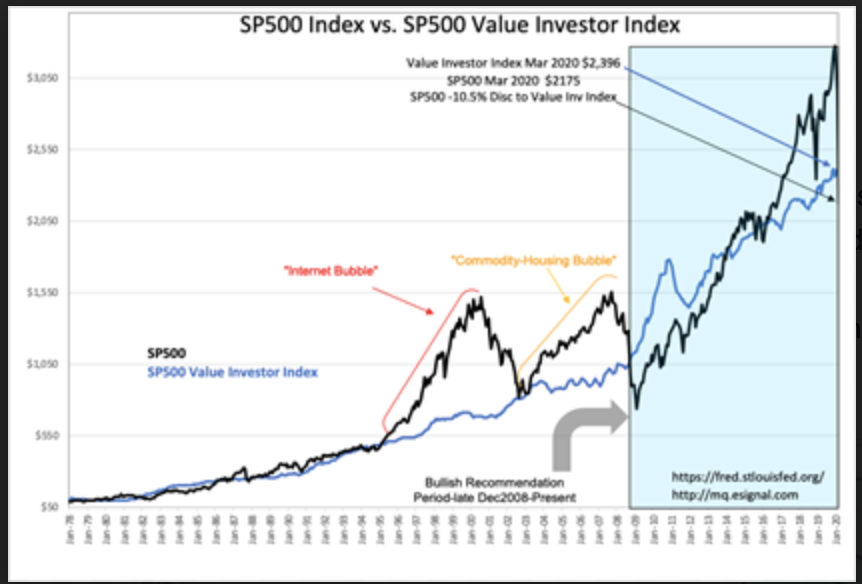

Market valuations look attractive to me:

https://www.valueplays.net/2020/03/30/market-nearing-2008-valuations/

Well, there is something different (or odd) about the current market. The instagram post below notes that the intraday trade has been profitable lately while the over-night trade has not. This is different from the Great Recession where both trades periods lost money, but the over-night did a bit better, relatively. Does this mean anything?

Walter

https://twitter.com/bespokeinvest/status/1248368169091239937

Hi Walter,

I am going to say this is likely to be caused by short sellers closing their positions at the end of the day and reopening them in the morning. Short sellers do not like holding positions overnight or over the weekends when stop losses cannot be executed. As you know short sellers can have unlimited losses in theory. But theory or not, with margin, they have considerable risk.

And there should be more short sellers in the market now (it is a good time to go short). Anecdotally, even Marco has been going short at times recently.

There is something else to consider that is probably not separate. Not separate because you can short ETFs too, I believe.

There are a whole bunch of people who are constantly looking at the NAV and iNAV of ETFs and arbing (statistical arbitrage) away the difference between ETFs and the value of the underlying assets.

High volume comes in at the end of the day and the price of the ETF moves away from the NAV (the true value of the underlying assets in the funds). The higher volume, time constraints and market on close imbalances always cause a difference in the NAV and the price of the ETF.

This difference can be expected to be greater now with the higher volumes. There have even been articles about large market on close trade imbalances recently.

The difference in the ETF’s price and the NAV get arbed away the next morning. The volume is less in the morning. The individual stock prices are changing to reflect new information. Everything comes back into line in the morning.

During the arbitrage in the morning both the price of the ETF and the underlying stocks move. They move closer together.

This last theory regarding NAVs can be tested by seeing if there has generally been a discount (or a premium)) on the SPY ETF at the end of the day. In other words whether the price of the ETF is generally greater than, or less than, the NAV at the end of the day. This information regarding the NAV can generally be found on a daily basis but you probably have to pay to get historical data.

Best,

Jim