Hi all,

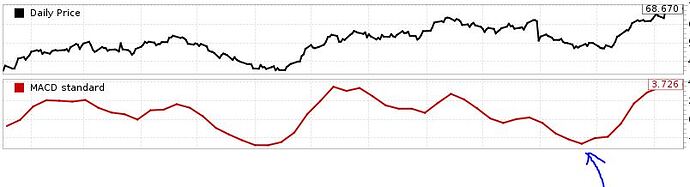

I would like to screen for stocks which recently had a turnaround in the MACD signal (see arrow in attachment).

To do this I need to create a formula which gives me the day (bars ago) in last 15 trading days with the lowest MACDD signal value, but not the value itself.

To get the lowest value itself I would simply use LoopMin

LoopMin("MACDD(12,26,1,CTR)",15)But what I am after is the CTR when this lowest value occurs, which fulfills the following condition:

MACDD(12,26,1,CTR)<MACDD(12,26,1,CTR+1) AND MACDD(12,26,1,CTR)<MACDD(12,26,1,CTR-1)

Does anybody know how I can implement this in a loop and get the CTR as answer, like

Eval(condition with loop, CTR,0)

Best regards,

Florian