This thread continues a side-discussion from a thought-provoking thread started by Georg Vrba on June 21, 2019: "What happened to Shiller CAPE #SPPE10 "

In examining the CAPE-10 back to 1871 on the Multpl.com site, it’s clear that prior to 1990 the median PE10 was about 15, while after 1990, the median PE10 is closer to about 25. Overall valuation levels have increased by 60 to 70% in the last 30 years!

Within that thread, I asked the P123 community for ideas on why this has occurred. Specifically; “Has there been a fundamental change that increased the valuation of corporate stocks in the last 29 years?”

David (primus) answered that “Yes there has” and he provided some excellent points to consider – including:

REDUCTION OF THE ‘FUDGE FACTOR’

I can appreciate that the implication of David’s first two points would be to reduce a corporation’s ability to ‘fudge’ their earnings numbers and that valuations prior to the current era (before 1990) may – MAY – have been closer to what we are seeing today if companies were forced to provide more accurate earnings reports as a result of Cash Flow Accounting and Mark-to-Market Accounting rules. In other words, a company valued with a PE of 25 today may have been valued at a PE of 15 in yesteryear because investors took into consideration that there was a good chance those earnings were inflated. Stated differently, “Investors today have more confidence in corporate earnings and are willing to pay more.” Not sure about that, but maybe…

CONSTRUCTING AN ‘ALTERNATIVE EQUITY RISK PREMIUM’

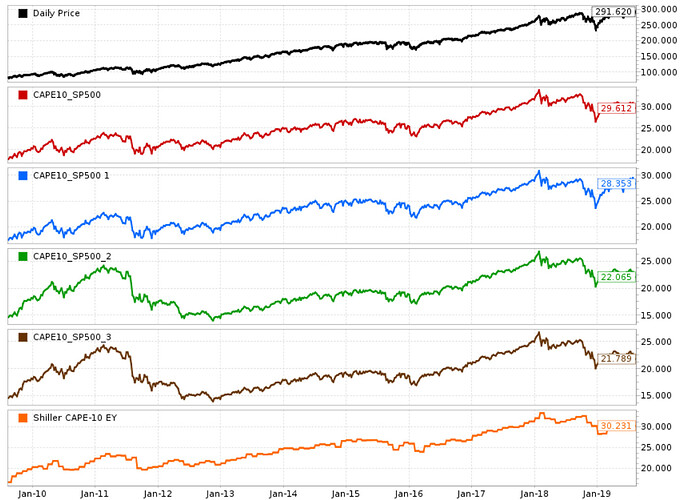

In this post, I want to focus on David’s third comment about a more accurate workaround for the Equity Risk Premium. He proposed a formula that first inverts the CAPE-10, then subtracts out the 10-year Treasury or Corp Bond Yield to produce a “TRUE cyclically adjusted equity risk premium.”

Compared to the Fed Model, this approach has innate appeal because it would be 1) cyclically adjusted and would consider both 2) interest rates and 3) inflation (incorporated in the CAPE-10 ratio) for an Alternative Equity Risk Premium measure.

While valuation is generally accepted to be a poor approach to determining market exposure/timing, this Alternative Risk Premium might help an investor determine whether the current investment environment is ‘hot’ or ‘cold’ for equities, then perhaps other measures designed for that environment can be employed for more accurate timing decisions. Perhaps.

However, when creating this series, I did not arrive at “a relatively stationary time series” as David imagined. Here are the charts for the two alternatives suggested, one subtracting the Corporate AAA Bond Yield and the other subtracting the US Treasury 10-yr Yield from the inverted CAPE-10:

Alternative Equity Risk Premium (w/CorpAAA Bond Yield)

Formula: (1/(Close(0,#SPPE10)))-(Close(0,##CORPAAA))

Alternative Equity Risk Premium (w/US 10-YR Treasury Yield Bond Yield)

Formula: (1/(Close(0,#SPPE10)))-(Close(0,##UST10YR))

As you can see, it appears that these series would be less than useful for the purpose of determining the valuation or risk environment.

David, can you (or any P123 member, for that matter) address this – and let me know if I have configured it incorrectly? Thanks.

Chris