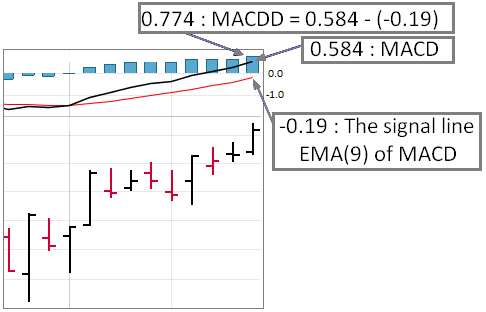

MACD(offset [, series]): the difference between a short EMA (12 bars) and a long EMA (26 bars). The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge.

MACDD(short,long [,period,offset,series]): when period is 2 or greater it returns the difference between the MACD and it's EMA (the signal line), otherwise when set to 1 (the default) it returns MACD. With this function you can specify your own long and short parameters, and the signal EMA period. Typical values are 12, 26 and 9.

NOTE: MACD(0) is equivalent to MACDD(12,26,1,0)

Parameters

short: the period of the short EMA

long: the period of the long EMA

period: the period of the signal line EMA. Set this to 1 to disable it and return MACD

offset: the offset in bars; 0 is for latest values

Examples

To screen for stocks that have a MACDD above 0 but were below 0 a week ago (indicating a possible recent crossover with the signal line) enter:

MACDD(12,26,9) > 0 and MACDD(12,26,9,5)<0

Series Parameter

By default, technical functions access the time series of the instrument in context. Normally, that is the Stock or ETF currently being evaluated or ranked. In specialized Ranking Nodes, the context depends on the node type. For example, in an "Industry Node" (used to rank Industries against each other), the industry benchmarks are the default context.

You can specify a different time-series in several ways like: using GetSeries(), specifying a StockID directly, or using a time series id. See the examples below.

Examples

Get the latest close price using Close(0, series) using different methods for different time series.

| Using the ID directly | |

| Using the StockID for SPY:USA* | Close(0, 24262) |

| For the Industry series of the stock being evaluated | Close(0,#Industry) |

| Using a Time Series Id | Close(0,$RUI) |

| For the benchmark | Close(0, #Bench) |

| Using GetSeries | |

| Using a fully qualified ticker | Close(0, GetSeries("SPY:USA")) |

| When USA is your default | Close(0, GetSeries("SPY")) |

| See GetSeries() for more examples like for aggregate series | |

| * StockIDs never change | |

Predefined Series IDs

These are special series ids. Additional Series Ids can be found in the reference under: MISC→TIME SERIES IDs

| Id | Description | Freq | OHLC |

| Industry and Sector | |||

| #Sector | Stock's Sector | Daily | C |

| #SubSector | Stock's SubSector | Daily | C |

| #Industry | Stock's Industry | Daily | C |

| #SubIndustry | Stock's SubIndustry | Daily | C |

| Miscellaneous | |||

| #Bench | Benchmark closing prices | Daily | C |

| #TNX | 10Y Treasury Note | Daily | OHLC |

| FED Model series (chart) | |||

| #SPRP | SP500 Risk Premium | Weekly | C |

| #SPEPSCY | SP500 EPS CurrentY | Weekly | C |

| #SPEPSNY | SP500 EPS NextY | Weekly | C |

| #SPEPSCNY | SP500 EPS Blend Y | Weekly | C |

| #SPEPSQ | SP500 EPS Blend Q | Weekly | C |

| #SPEPSTTM | SP500 EPS Trailing 12 months | Weekly | C |

| #SPYield | SP500 Yield | Weekly | C |

Special Series Ids for Moving Averages & Highest/Lowest functions

| Id | Description | Context |

| #Open | Open prices | Stock & ETF |

| #High | High prices | Stock & ETF |

| #Low | Low prices | Stock & ETF |

| #Vol | Volumes | Stock & ETF |